How will Biden's student loan forgiveness affect me? Here are answers to some scenarios

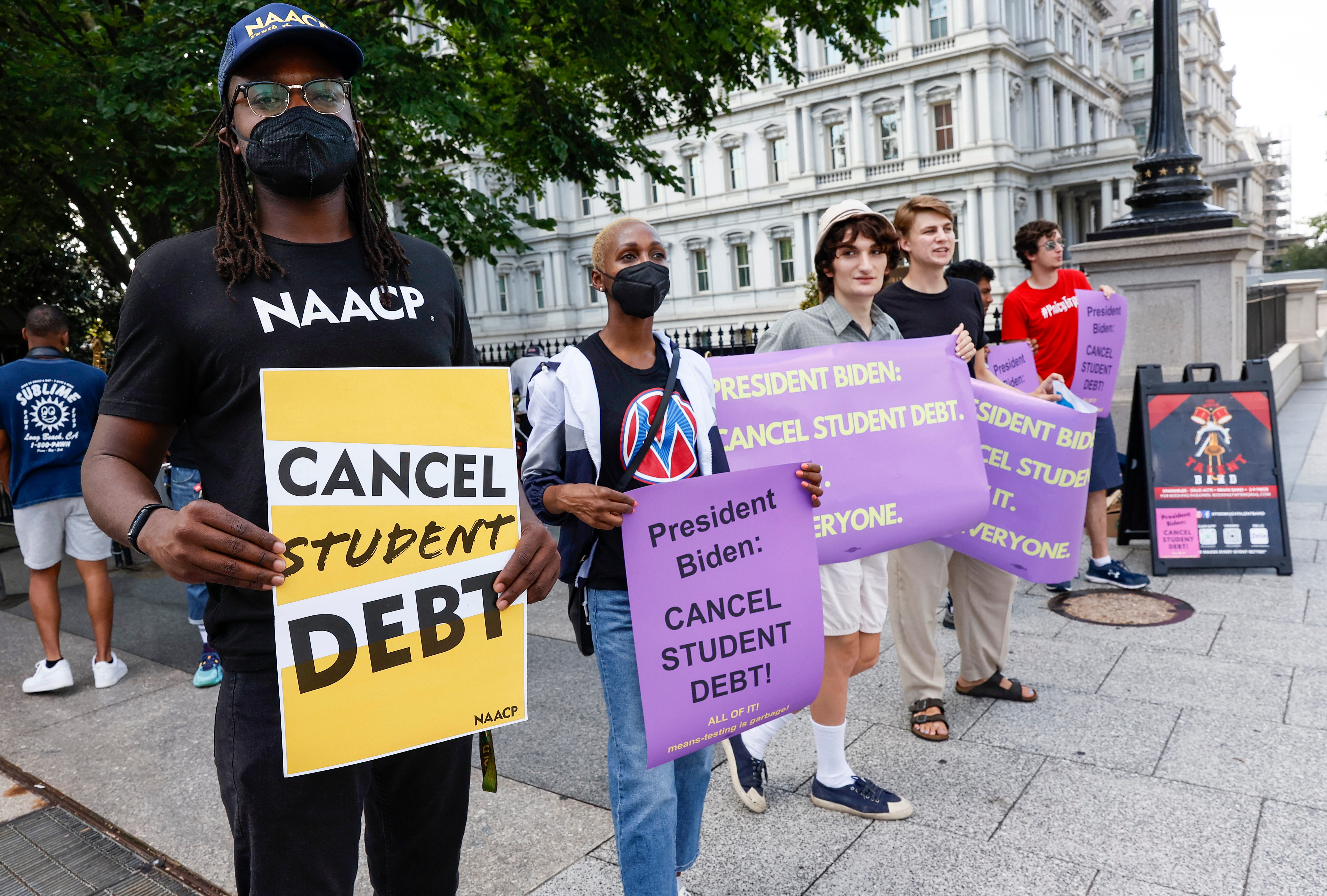

Details are still to come on President Joe Biden's plan to forgive up to $20,000 in student loan debt.

But one thing is likely: At least a handful of unique circumstances remain for some borrowers.

In general, the plan announced Wednesday will erase the debt for those who make less than $125,000 a year or $250,000 for married couples or head of households. Pell Grant recipients are to receive up to $20,000 in relief, and other borrowers receive $10,000.

More details are expected in the next few weeks from the U.S. Department of Education. Paste BN asked Betsy Mayotte, president of The Institute of Student Loan Advisors, a nonprofit organization that provides advice on student loans, to consider unique circumstances some borrowers face. Here's her perspective.

How do I get my student loans forgiven?: 'Debt and no degree': Biden cancels as much as $20K in student loan debt: Recap

Do I qualify?: What to know about Biden's student loan debt forgiveness plan.

Paste BN: If I have $40,000 in student loan debt (the average is $25,000). What does the $10,000 in forgiveness mean for me?

A: That depends on your income and what kind of loans you have. If they are federally held federal loans (which the vast majority are) and you have an adjusted gross income of under $125,000, you would be eligible for the full $10,000 in forgiveness.

We aren’t sure how that would be applied to the loans, so it’s hard to say how it would affect your future payments.

If, for example, it's applied to the highest interest rate loans first rather than evenly across all loans and it ends up paying one or more loans off, then your monthly payment could go down.

If you were on an income-driven plan (sets monthly student loan payment at an amount that is intended to be affordable based on income and family size) however, the payment would probably stay the same regardless of how it was applied.

If you assume a 5% interest rate, you would be saving about $42 a month in interest.

Paste BN: My gross annual income is $126,000, and I have about $10,000 in student loan debt. It would appear I make too much to qualify for forgiveness. What is the basis for the income caps? Is it gross income or adjusted gross income, which is under the federal cap for me after I take deductions on my annual tax return?

A: It appears the federal government will be using adjusted gross income.

Biden to shrink discretionary income: What is it? Why it matters in student loan repayment

Paste BN: I’m living with a significant other, and we are thinking of getting married next year. Currently, I make too much money for loan forgiveness as a single adult. But as a married couple, I would qualify for loan forgiveness. Would I get my loan forgiven once I’m married?

A: It doesn’t appear you would. The plan is looking at AGI (adjusted gross income) for the 2020 and 2021 tax years only.

Paste BN: Once the federal government forgives $10,000 in student loan debt, how will that affect my credit score? I’m hoping to buy a house.

A: Good question, and the answer may vary. For some it will increase their score if say, this pays off a defaulted loan.

Your overall credit profile may improve as well by the nature of improving your debt-to-income ratio. But if this pays off the loan and you don’t have a broad credit history, it could actually cause it to drop a bit.

Have a tip on business or investigative stories? Reach the reporter at craig.harris@usatoday.com or 602-509-3613 or on Twitter @CraigHarrisUSAT or linkedin.com/in/craig-harris-70024030/