Trump's 'no tax on tips' is getting close to the finish line. Here's how it will work.

The Senate on July 1 narrowly approved Trump's tax bill, which includes a provision that would make the president's “no tax on tips” campaign promise a reality.

A "no tax on tips" proposal has broad support among politicians and Americans across party lines, though critics – including a restaurant trade group – warn the tax break could be costly and apply only to certain workers.

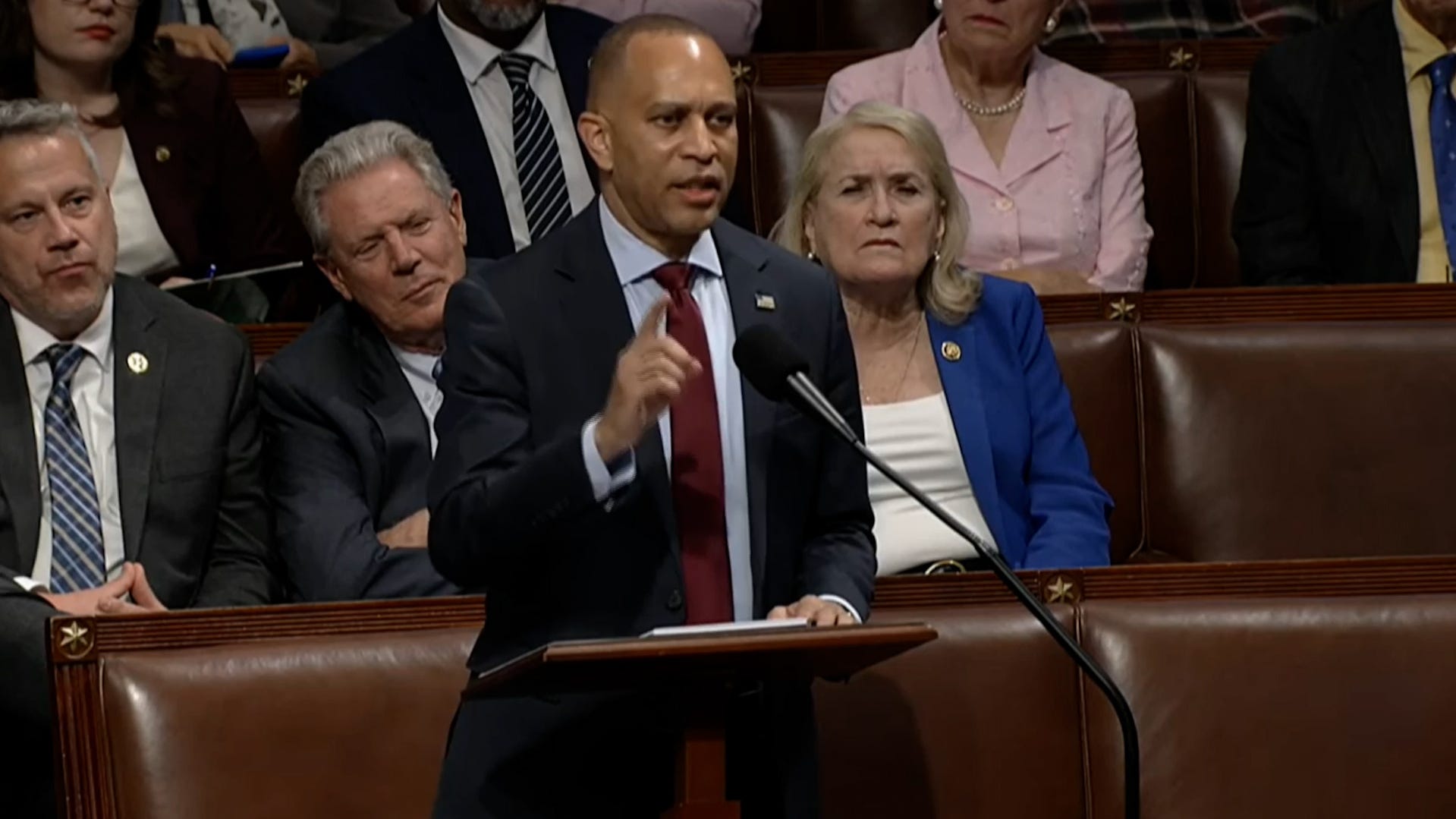

The House on July 3 passed Republicans' sweeping tax and policy bill, which includes a provision that would make President Donald Trump's “no tax on tips” campaign promise a reality. Trump is set to sign the bill into law during a July 4 ceremony at the White House.

Here’s what we know so far about how "no tax on tips" could roll out and who would benefit.

How would ‘no tax on tips’ work?

The tax bill, which narrowly passed the Senate on July 1, creates a temporary tax deduction for income from tips through 2028.

The tax break applies to workers who “customarily and regularly" receive tips − servers, for example. Workers can deduct up to $25,000 worth of tips, with those who make more than $150,000 per year eligible for a reduced deduction.

The bill also creates a new deduction for overtime pay through 2028. The deduction is capped at $12,500, with workers who make more than $150,000 eligible for smaller deductions.

Who would benefit from no taxes on tips?

Because the tax cut would not apply to payroll taxes, the roughly 37% of tipped workers who don't make enough to pay federal income taxes would see no benefits from the tax break, according to a 2024 estimate from the Yale Budget Lab based on 2022 tax figures.

Erika Polmar, executive director of the Independent Restaurant Coalition, said the tax break would also be confusing and unfair for certain workers because it does not accommodate service charges, an alternative to tips.

“This bill is ultimately unfair to the line cooks, dishwashers, porters, and prep staff that are vital to independent restaurants,” Polmar said in a July 1 statement. "We urge Congress to amend the tax code so all gratuity-based income — tips and service charges — earns the same relief, giving businesses a single, stable set of rules."

Polmar added that the tax break would be "costly to business owners and taxpayers alike.” The nonpartisan Congressional Budget Office projects that no taxes on tips could increase the deficit by $40 billion through 2028.

There are also concerns that the tax break could exacerbate the country's tipping fatigue. The IRC statement points to a report from the Economic Policy Institute, a left-leaning think tank, that says the proposal could incentivize employers to lean even more heavily on tips.

The bill has received praise from the National Restaurant Association, another industry trade group.

The association is “pleased to see” the inclusion of policies that deduct taxes on tips and overtime, according to Sean Kennedy, the group's executive vice president for public affairs.

“This bill includes the most important pro-growth tax policies restaurant operators need to continue to power the national economy,” Kennedy said in a July 1 statement. “We appreciate the work that has gone into getting this bill through the Senate and encourage the House to quickly pass it, sending it to the President for signature.”

How much would workers save?

The average tax cut for families that benefit would be roughly $1,700, while the bottom 20% of earners would save $200, according to the Budget Lab.

A February analysis from the Tax Policy Center, a joint venture from the Brookings Institution and the Urban Institute, found ending taxes on tips would benefit about 2% of all households, or 60% of households with tipped workers, with an average tax cut of roughly $1,800 per year.

(This story was updated to add new information.)