US stocks slide as White House plans new tariffs, inflation fears ignite hawks

U.S. stocks slid Wednesday as the White House readied new tariffs.

The S&P 500 fell 64.45 points, 1.1%, to close at 5,712.20, while the blue-chip Dow gave back 132.71 points, 0.3%, to hit 42,454.79. The tech-heavy Nasdaq tumbled 2%, losing 372.84 points, and closed at 17,899.02.

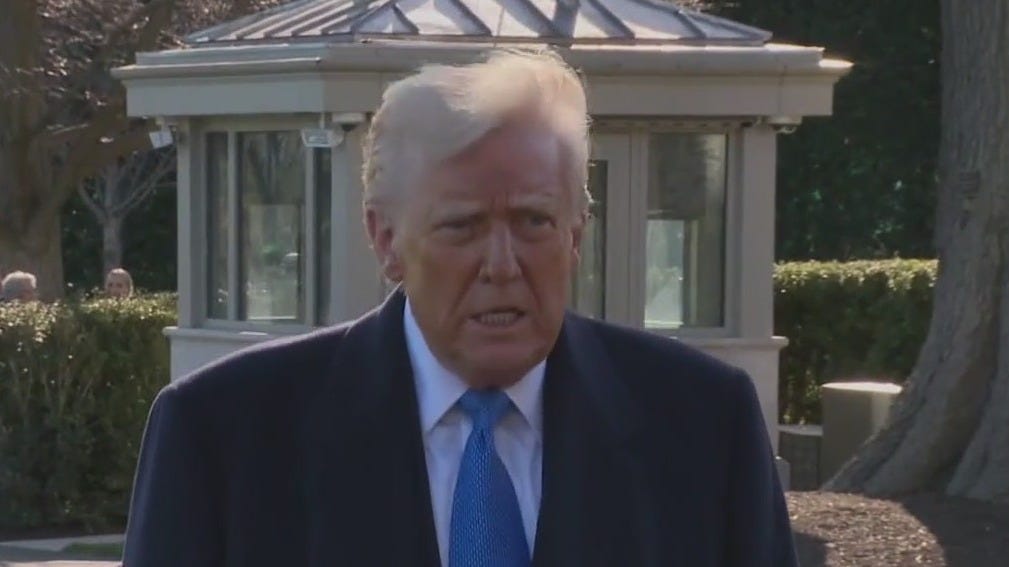

Stocks opened mixed but turned lower midday after media reports that President Donald Trump was planning tariffs on autos to be announced as soon as Wednesday. Shares of Stellantis N.V. and General Motors closed lower.

Markets have moved in tandem with White House rhetoric on tariffs. Stocks surged Monday after Trump said new levies due to take effect on April 2 might be more limited than investors expected. But he walked back some of that talk and added some additional industries to his list for tariffs sometime “down the road," which kept stocks muted on Tuesday.

In economic news, orders for long-lasting goods like refrigerators were unexpectedly higher in February, the Commerce Department said Wednesday morning. So-called durable goods orders were 0.9% higher for the month, beating analyst forecasts of a decline.

On Tuesday, Austan Goolsbee, president of the Chicago Fed and a voting member on the Federal Reserve's monetary policy board, said recent readings of inflation expectations could be a "major red flag of concern." St. Louis Fed president Alberto Musalem said Wednesday that new tariffs could have a more lasting impact on inflation, rather than being "transitory," as Fed Chair Jerome Powell has argued.

The benchmark 10-year Treasury note added about 3 basis points to close near 4.34%. Bond yields rise when prices fall, and higher inflation erodes the value of bonds that have already been issued.

"I would be wary of assuming that the impact of tariff increases on inflation will be entirely temporary," Musalem said in remarks in Kentucky.

Gold prices ticked down slightly, but remained firmly above the $3,000 an ounce benchmark. The precious metal is often considered a safe haven against inflation and geopolitical uncertainty, and has recently traded near all-time highs.

Corporate news

Tesla shares lost nearly 6% after Canada said on Tuesday that it would freeze rebate payments for the electric carmaker and exclude it from future rebate programs.

Shares of Dollar Tree reversed early losses to close about 3.4% higher after the discount store chain reported a wider-than-expected loss in the fourth quarter. The company also confirmed that it would sell its Family Dollar business.

GameStop Corp. shares jumped nearly 12% after the company announced an earnings beat and said it planned to use its cash to buy Bitcoin.

Tech heavyweight Nvidia closed more than 5% lower.