US stocks end near flat but end month with big gains. Trump reescalates China tariff war

U.S. stocks closed little changed, brushing off cooler-than-expected inflation data to focus on a reescalation of tariff wars.

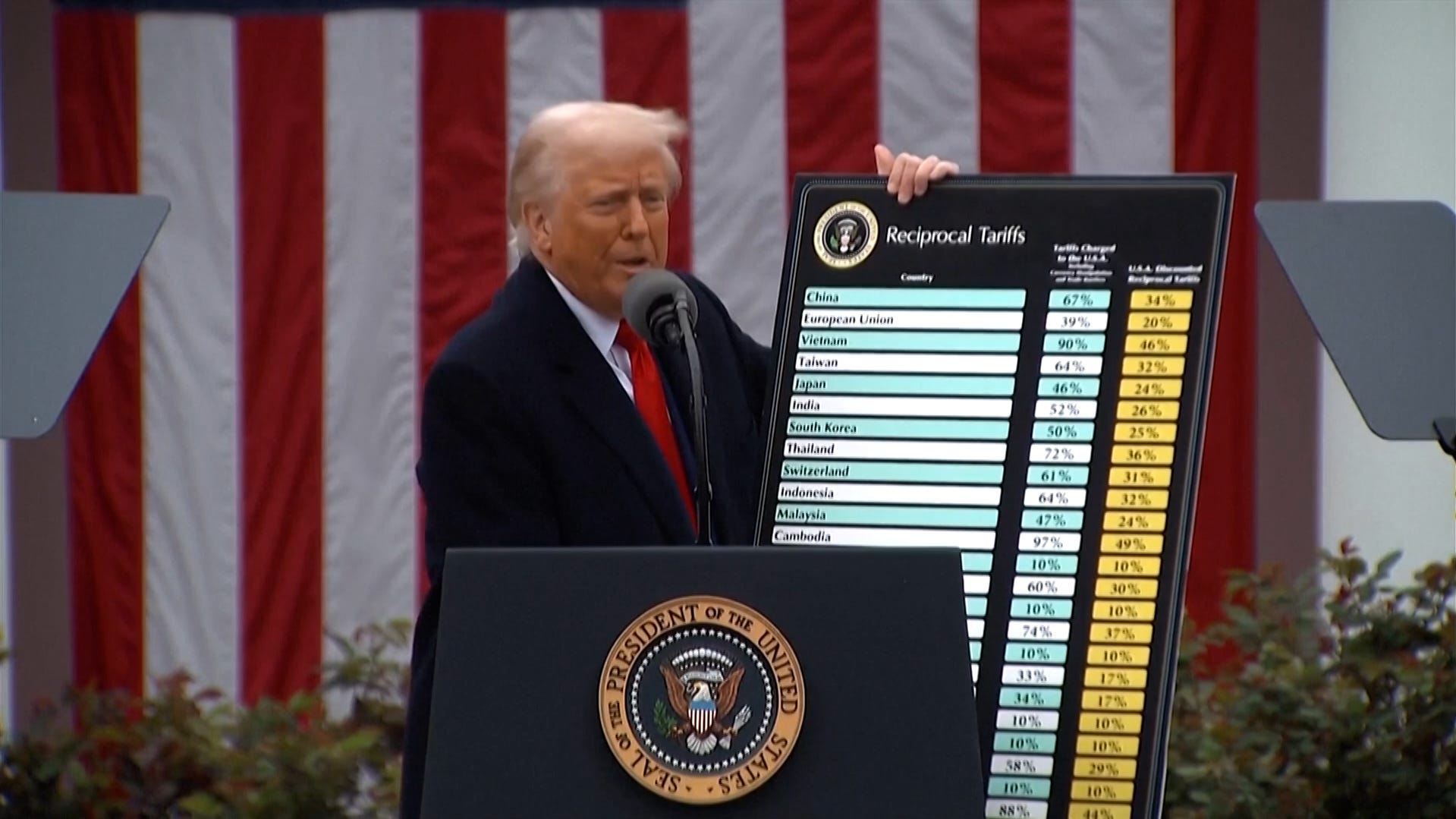

President Donald Trump accused China of violating a tariff pause agreed to earlier this month in Switzerland.

"China, perhaps not surprisingly to some, HAS TOTALLY VIOLATED ITS AGREEMENT WITH US. So much for being Mr. NICE GUY!" he wrote in a social media post.

The administration is planning to broaden restrictions on China’s tech sector, Bloomberg reported, citing sources. It said officials are drafting regulations that would impose U.S. government licensing requirements on transactions with companies that are majority-owned by already-sanctioned firms.

The blue-chip Dow added 0.13%, or 54.34 points, to 42,270.07; the broad S&P 500 lost 0.01%, or 0.48 point, to 5,911.69; and tech-laden Nasdaq shed 0.32%, or 62.11 points, to 19,113.77. The benchmark 10-year Treasury yield slid to 4.4%.

Earlier, Treasury Secretary Bessent said in a Fox News interview that U.S.-China trade talks “are a bit stalled." Investors had hoped a real trade deal, not just a pause, would emerge with China after surprisingly productive talks in Switzerland earlier in the month.

Trump's tough talk comes on the heels of court battles over his aggressive tariff plan. A federal court halted his tariffs, saying the president overreached in using an old law on the books to enact his levies. The administration appealed and the appeals court let the tariffs stand for now as the case works its way through the appeals process. Some say the case could end up decided by the Supreme Court.

In the meantime, Trump is already looking at ways to implement tariffs while the case makes its way through the appeals process, the Wall Street Journal said. The administration is considering using a provision of the Trade Act of 1974 to implement tariffs of up to 15% for 150 days, it said.

"Given Trump's public ire against previous court rulings and the press questions on May 28 around the 'TACO' narrative emerging in the media (Trump Always Chickens Out), we would not be surprised to see a meaningful tariff escalation/response from the White House sooner rather than later," wrote Chris Krueger at TD Cowen in a note after the court rulings.

Despite some weakness on the final trading day in May, the S&P 500 and Nasdaq each had their best month since November 2023. The Dow saw its biggest monthly gain since January. All three indexes also were higher on the week.

Inflation cools

The Federal Reserve's preferred inflation gauge, the annual personal consumption expenditures price index (PCE), rose 2.1% in April, a touch lower than the Dow Jones mean forecast of 2.2%. The core rate, excluding the volatile food and energy sectors, rose 2.5%, also less than predictions for 2.6%.

The report also showed consumer spending slowed, as expected, but personal income jumped 0.8% on the month, ahead of forecasts for 0.3%.

"The key figure is the increase in income, which was unusually strong," said Robert Frick, corporate economist with Navy Federal Credit Union. "Spending follows income, so that points to the expansion continuing at a solid clip."

Americans feel (a little) better

The University of Michigan consumer survey was a little better than expected but flat from April at 52.2 and still at the lowest level since July 2022.

"Consumer and business confidence has cratered, unsurprisingly," wrote James Smith, developed markets economist at Dutch bank ING, in a note. "But the hawks over at the central banks – both in the U.S. and out – would argue that people don’t always do what they say. The ‘hard data’ – the official numbers on everything from spending to hiring – currently isn’t looking so bad."

Corporate news

- Gap sees second-quarter revenues below Street forecasts. Shares plunged 20%.

- Discount bulk retailer Costco's quarterly results topped expectations. Shares were up 3%.

- Regeneron shares dropped 19% after the company's experimental drug for patients with a type of lung condition commonly called "smoker's lung" failed a late-stage trial, although it succeeded in another.

- Dell's sales in the first three months topped analysts' forecasts and raised its full-year guidance. Shares fell 2%.

- Marvell Technology swung to a profit, fueled by strong demand for artificial intelligence. Shares shed 5.5%.

- American Eagle Outfitters swung to a loss in the first three months. Shares fell about 2%.

- Zscaler reported higher third-quarter revenue and slightly increased its full-year sales guidance. Shares added almost 10%

- Ulta boosted its full-year outlook and posted higher-than-expected first-quarter sales. Shares gained nearly 12%.

- UiPath raised its annual sales outlook after posting higher quarterly revenue, boosted by strong renewals from public-sector customers. Shares of the automation software company rose almost 3%.

Cryptocurrency

Trump Media & Technology Group raised around $1.44 billion from selling stock at $25.72 per share and raised about $1 billion in convertible bonds, to buy Bitcoin for its treasury. Shares of Trump Media rose about 2.5%.

Bitcoin was last down 1.01% at $104,590.30.

This story was updated to add new information.

Medora Lee is a money, markets, and personal finance reporter at Paste BN. You can reach her at mjlee@usatoday.com and subscribe to our free Daily Money newsletter for personal finance tips and business news every Monday through Friday.