US stocks end mostly higher, with S&P 500 and Nasdaq at records, on solid earnings

U.S. stocks ended mostly higher, with the broad S&P 500 and tech-heavy Nasdaq climbing to record highs again, as investors digest more earnings reports and look forward to some from the largest technology companies later this week.

Of the 62 S&P 500 companies that have reported thus far, more than 85% have topped expectations, according to FactSet data. Morgan Stanely Chief U.S. Equity Strategist Mike Wilson said earnings momentum could continue lifting the S&P 500 and forecasts the index to climb to 7,200 points by mid-2026.

This morning, Verizon boosted its annual forecast, Domino's Pizza topped analysts' estimates for second-quarter same-store sales and Cleveland-Cliffs reported a narrower-than-expected loss and credited Trump's tariffs and support for the steel industry.

However, the main events come later in the week, with Alphabet and Tesla, the first of the so-called "Magnificent Seven," reporting earnings midweek. Investors will scrutinize their earnings to see if artificial intelligence spending remains strong or if President Donald Trump's tariffs and trade disputes are having any effect on outlooks.

The blue-chip Dow fell late, closing down 0.04%, or 19.12 points, to 44,323.07. The S&P 500 rose 0.14%, or 8.81 points, to 6,305.60 to close for the first time above 6,300. The Nasdaq gained 0.38%, or 78.52 points, to 20,974.18. The Nasdaq also notched an all-time high.

The benchmark 10-year Treasury yield fell to 4.384%.

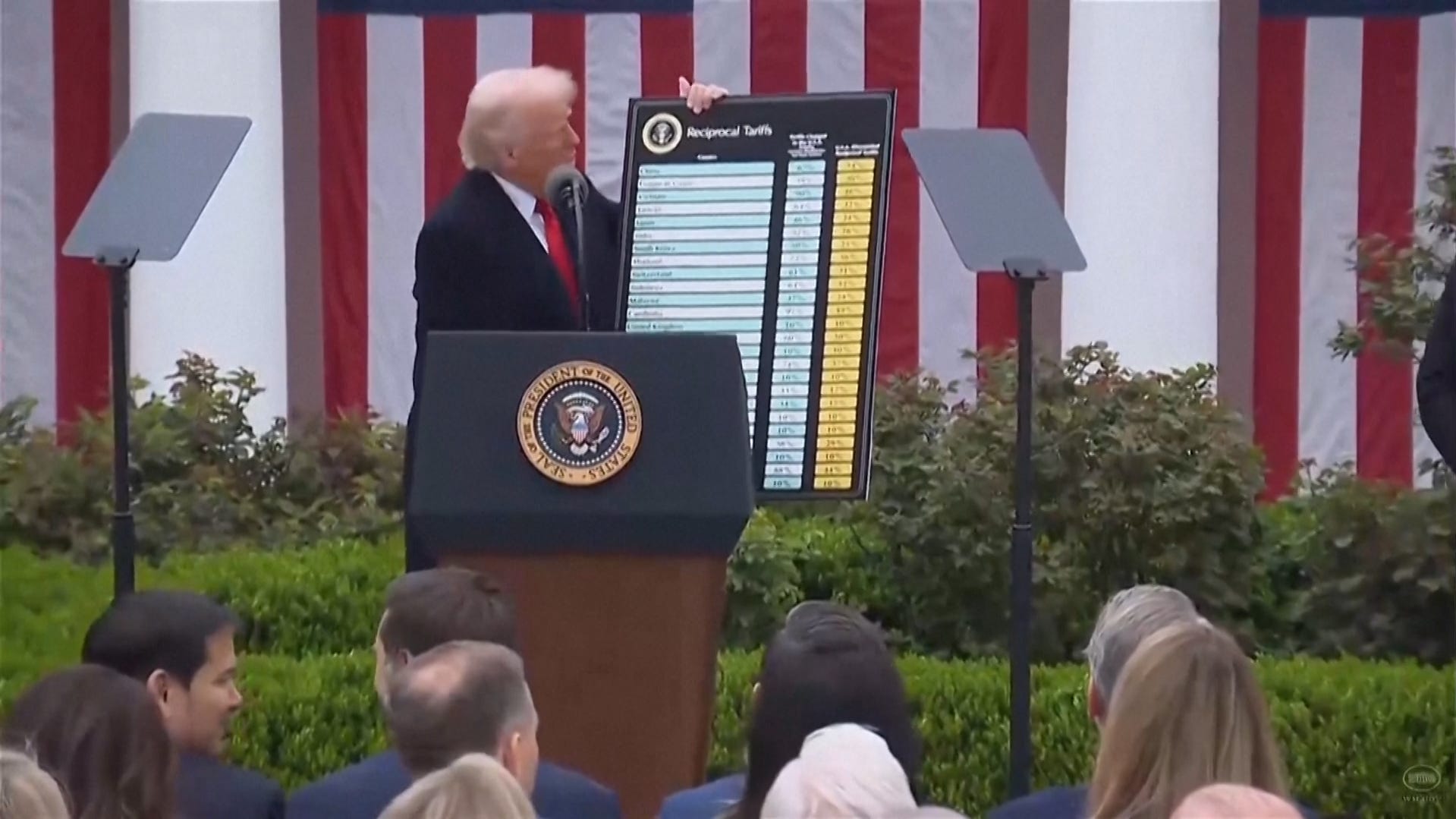

Over the weekend, U.S. Commerce Secretary Howard Lutnick called Aug. 1 the “hard deadline” for countries to start paying tariffs, though he also added that “nothing stops countries from talking to us after August 1.” However, he also expressed optimism that a deal with the EU would be struck.

Meanwhile, the European Union is planning retaliatory tariffs if the bloc can't strike a deal with the U.S., Bloomberg reported. This comes after the FT said last week the U.S is looking at enacting a minumum 15% to 20% tariff on all EU goods with few exceptions. Trump earlier had threatened a 30% tariff on most EU imports, starting Aug. 1.

Investors shrugged off a larger-than-expected decline in June leading indicators. Leading indicators declined 0.3% to 98.8, more than the 0.2% drop expected by a consensus of economists polled by The Wall Street Journal. Leading indicators are seen as giving early warning signals of anticipated shifts in the business cycle.

More on Trump's battle with Powell

Trump denied a Wall Street Journal report saying Treasury Secretary Scott Bessent persuaded the president not to fire Federal Reserve Chair Jerome Powell.

Bessent reportedly warned Trump of the possible effects on the economy and markets and the likely political and legal obstacles that such a move would face. He also said the Fed is already moving toward cutting interest rates later this year, and that the economy is doing well and markets have responded positively under the president's policies, the story said, citing sources.

In a social media post, Trump disputed this account, saying he did not need anyone to explain this to him. He already knows what is good for markets and the U.S.

However, attacks on the Fed continue. Bessent suggested Monday morning in an interview on CNBC “what we need to do is examine the entire Federal Reserve institution and whether they have been successful. Has the organization succeeded in its mission? If this were the (Federal Aviation Administration) and we were having this many mistakes, we would go back and look at why has this happened.”

Powell is slated to speak at a conference in Washington, D.C. at 8:30 a.m. ET, in his last scheduled remarks before the central bank's policy meeting next week.

Corporate news

- Stellantis said tariffs cost it about 300 million euros in the first half of the year, By the end of the year, that figure is expected to total between 1 billion and 1.5 billion euros. It warned it would post a net loss of 2.3 billion euros for the first half of the year, the worst result since it was created through the 2021 merger of Fiat Chrysler and Peugeot. Less one-time effects, the company said adjusted operating profit would be 0.5 billion euros, compared with an analyst consensus of 1.9 billion euros, according to FactSet. Shares edged up.

- Block will join the S&P 500 at midweek. Shares rallied 7.22%.

- Microsoft said its server software was being attacked. It urged customers to install new security updates. The stock inched up.

- Domino's Pizza's second-quarter same-store sales beat analysts' forecasts for the first time in five quarters. However, earnings per share still missed expectations and revenues were in line. The pizza chain's stock slipped fractionally.

- Alaska Airlines has resumed operations after the airline grounded its entire fleet for several hours over the weekend due to a software outage. Shares lost 1.02%.

- Verizon's second-quarter results topped analysts' forecasts. The company also lifted its annual guidance. The wireless company's shares gained 4.15%.

- Bruker issued weaker-than-expected guidance for the second quarter. Shares slid 12.12%.

- Cleveland-Cliffs reported a smaller-than-expected second-quarter loss and revenues matched. Steel shipments hit a record 4.3 million net tons. Shares jumped 12.33%.

Cryptocurrency

Cryptocurrency exchange Bullish filed to go public with the ticker symbol BLSH. As of March 31, the total trading volume since launch has exceeded $1.25 trillion, the company said in its filing. The company is backed by billionaire investor Peter Thiel.

The filing comes after the blockbuster initial public offering of stablecoin issuer Circle. Circle shares have jumped more than sevenfold since its IPO in June.

Separately, Trump Media & Technology shares rose 3.11% after the company said it acquired about $2 billion in Bitcoin and related securities.

Bitcoin was last down 0.33% at $116,910.50.

(This story was updated with new information.)

Medora Lee is a money, markets, and personal finance reporter at Paste BN. You can reach her at mjlee@usatoday.com and subscribe to our free Daily Money newsletter for personal finance tips and business news every Monday through Friday.