How will climate change impact American companies? The SEC unveils landmark proposal

- A proposed rule by the Securities and Exchange Commission would require U.S. companies disclose the risks they face from climate change.

- The rule would allow investors to judge how well a company is prepared for the future costs of a warming planet.

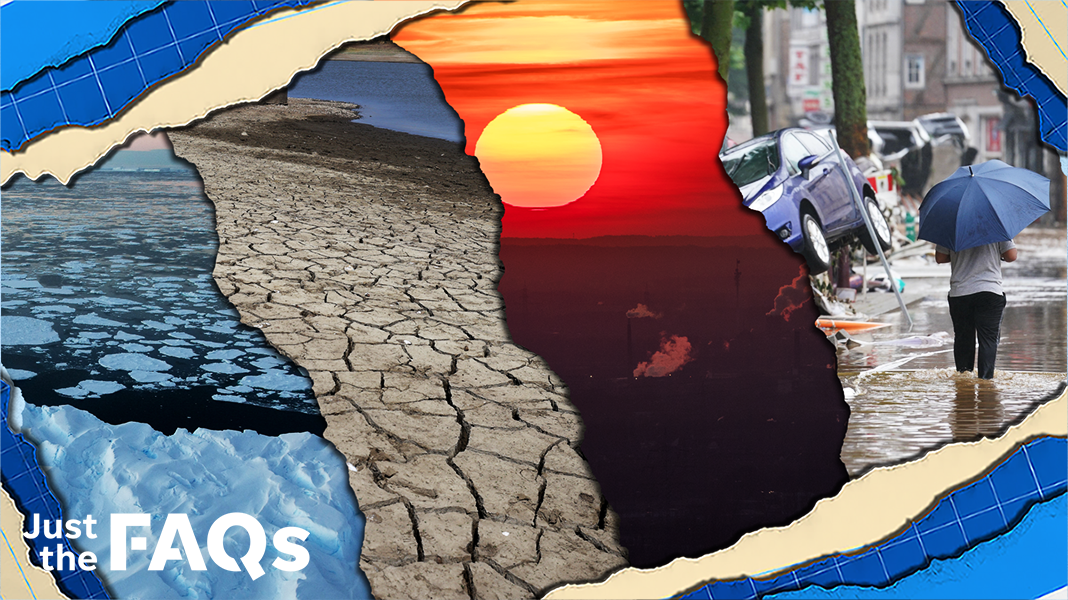

- The financial risks posed by a changing climate are real and expensive. Last year weather and fire disasters in the U.S. caused more than $145 billion in damages.

Would you invest in a winery whose vineyards might not be able to grow grapes in a decade? Take a job at a factory that might be underwater in 15 years? Buy hamburger from a company that’s burning the Brazilian savanna to grow soybeans to feed cattle?

Groundbreaking federal regulation unveiled Monday could change how Americans – and American companies – think about climate change. The proposed Securities and Exchange Commission rule would require public companies to disclose the risks they face from global warming.

Much as homebuyers are protected by rules requiring a seller to disclose problems, the new SEC rule would allow investors to judge how well or poorly a company is prepared for the future costs of a warming planet.

The proposed rule, which the SEC announced Monday morning, would require all publicly traded U.S. companies to tell investors about their greenhouse gas emissions and how they manage risks related to climate change and future climate regulations.

"There's increasing concern that investors are not fully informed of the climate risks companies face," said Michael Gerrard, faculty director of the Sabin Center for Climate Change Law at Columbia University. "The proposal will make it much harder for companies to make squishy claims about carbon neutrality. They'll need to put up or shut up." said Michael Gerrard, faculty director of the Sabin Center for Climate Change Law at Columbia University. "There's increasing concern that investors are not fully informed of the climate risks companies face."

The SEC, which ensures investors get accurate and transparent information about stocks, bonds and corporate profitability, was created by Congress after the 1929 stock market crash. Many Americans had invested in companies that had not been truthful about the risks they faced.

"The SEC was created to ensure it would not happen again. Climate change is a huge risk," said Paula DiPerna, a special adviser to CDP, a nonprofit that runs a voluntary climate disclosure system for companies.

Once the rule is published on the SEC's website the public will have 60 days to submit comments. The agency then takes those into consideration before issuing a final rule that will then be voted on by its four commissioners. The process is expected to take several months.

If passed, the requirements will be phased in, with large companies starting disclosures in 2023 and smaller ones in 2024.

The proposed rule won't only affect large investment companies but also the 56% of Americans who own stock either individually or as part of their retirement and pension plans.

Environmental groups believe investors will reward companies that become more climate friendly once they are required to be transparent about the financial risks global warming poses to their bottom lines.

The financial risks posed by a changing climate are real and expensive. Last year weather and fire disasters caused more than $145 billion in damages, including 20 separate events that each cost at least $1 billion in damage, the National Oceanic and Atmospheric Administration reported.

In 2021, the average temperature in the contiguous United States was 2.5 degrees above the 20th-century average. It ranked as the fourth-warmest year in the 127-year period of record. The six warmest years have all occurred since 2012.

"Even if you don't care about the climate, you might want to understand how your investments might do," said Sarah Dougherty of the National Resources Defense Council, who previously worked for the Federal Reserve Bank of Atlanta.

"The core idea is that people need to have good data so they can make informed decisions," she said.

Shareholders have been demanding such information, which some companies already make available voluntarily. If approved, the rule would for the first time require companies to provide standardized information that would allow investors to do apples-to-apples comparisons.

In a letter to the SEC, the North American Securities Administrators Association said it supported efforts to bring uniformity to climate change disclosures "because investors are increasingly considering climate change risks in their investment decisions."

BlackRock, an investment management company with $10 trillion in assets, said in comments to the SEC it strongly supported such a rule because it "will help enable investors to make more informed decisions about how to achieve durable long-term returns."

The impact of climate transparency

While many investors and environmentalists support the rule, some business groups oppose it. The U.S. Chamber of Commerce in comments to the SEC said the "inherently uncertain nature" of environmental data means businesses should not be liable for such disclosures.

Many conservative politicians also are pushing back. A March 7 letter from Republicans on the Senate Committee on Banking, Housing and Urban Affairs suggested the rule could limit U.S. energy producers' "access to credit and capital."

Republican state attorneys general say the SEC does not have the authority to require such disclosures. West Virginia’s attorney general called it “mission creep” and has threatened to sue the SEC if the rule is adopted.

Environmental groups say the rule wouldn't force anyone to either buy or not buy a given stock, merely level the playing field. If a huge investor or a pension fund wants to know about a company's risk they can get the information.

But "if you're an average consumer you have no way to do that," said Dougherty. "There are some people who have turned this into a political thing but it's really about giving people more data."

The rule has been long in the making. The SEC first announced guidance on climate disclosure in 2010 but didn't enforce it. A Congressional Research Service report in 2013 found many businesses "characterized the SEC’s level of enforcement in this area as negligible."

As concerns about climate change have grown in the intervening dozen years, so have calls for greater transparency.

In addition to reporting greenhouse gas emissions and financial risks from climate change, companies might also have to disclose how the transition to carbon-neutral energy production or increased environmental regulation could affect them.

Businesses that invest heavily in fossil fuels, for example, might face lower earnings if it becomes clear there will be less demand for them in the future as the economy shifts to energy sources such as wind, solar and possibly nuclear.

The regulation would only require companies to tell investors what their risks are, not force them to do anything about it.

"It's not the SEC's obligation to require you to reduce your risk," said DiPerna. "The SEC is not the Environmental Protection Agency."

It is the SEC's job, however, to make sure companies are being honest about their claims. If well-defined reporting becomes mandatory, some companies will be shown to not be as green as they claim, said Gerrard.

That's where the rule would have teeth.

"If you're found to be lying to the Securities and Exchange Commission," said DiPerna, "it's securities fraud."