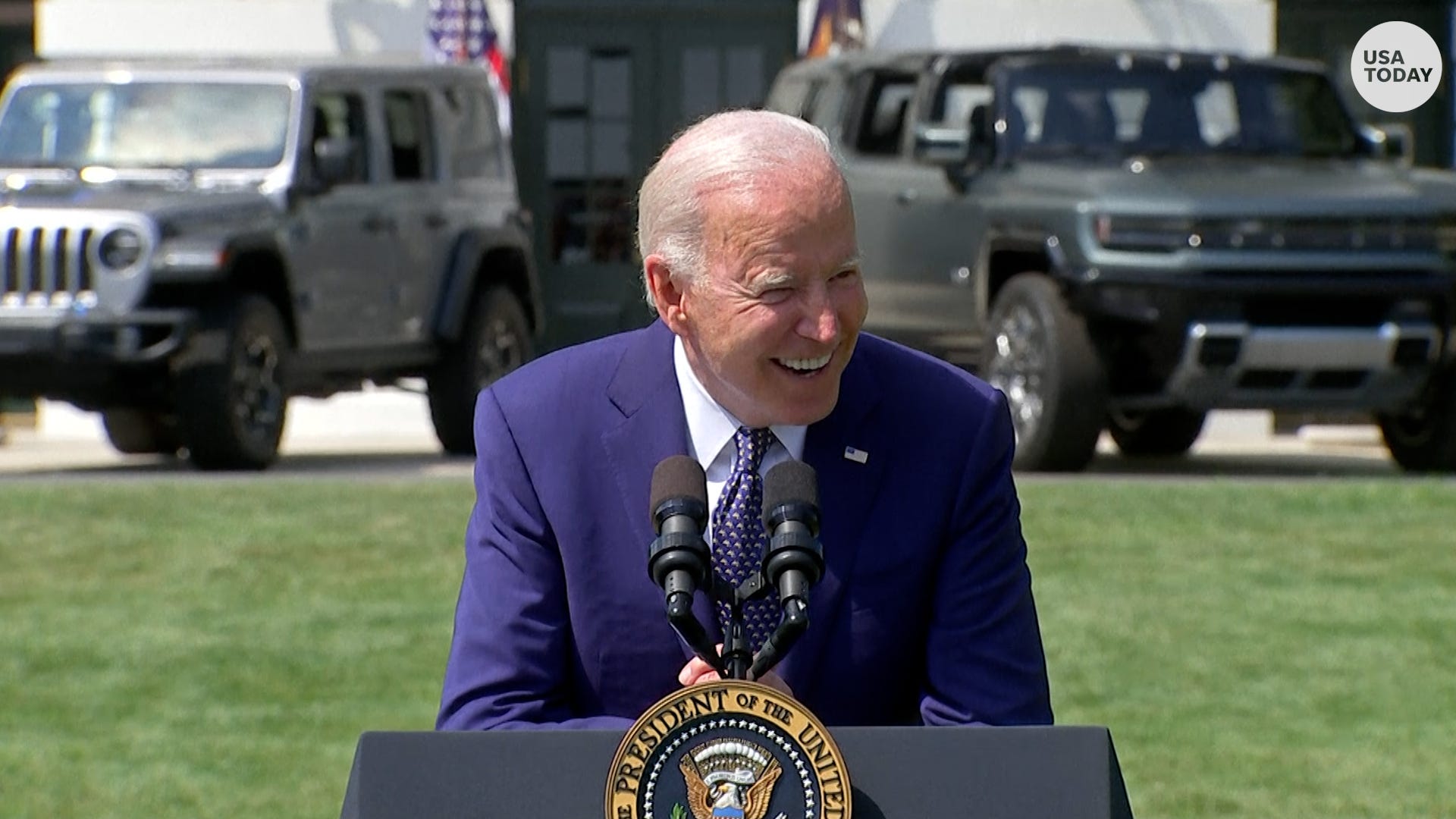

Biden's ambitious electric vehicles agenda: Here's what it would take to make it happen

In order to reach President Joe Biden's goal of having 50% of the new cars and light-duty trucks sold in the U.S. by 2030 be zero-emission, the federal government — meaning Congress — is going to have to put big subsidies in place.

Democrats, with the slimmest of majorities in the U.S. Senate and House, appear ready to try to shove some of them through in the coming weeks over the objections of Republicans.

On Monday, a vote appeared imminent in the Senate early this week to pass a bipartisan infrastructure bill that includes $550 billion in new spending on roads, bridges and broadband — $7.5 billion of which would go toward building charging stations for electric vehicles across the U.S.

But that's only half of what Biden originally wanted for charging stations. Now, the most significant incentives being eyed by Democrats to get companies to make more electric vehicles (EVs) and customers to buy them will be tucked into an as-yet unfinished $3.5-trillion budget reconciliation bill, a grab-bag of Biden administration priorities from expanding Medicaid to funding child tax credits and much, much more.

It's likely to include proposals to shave as much as $12,500 off the price of a new EV if it's made in the U.S. by union labor; to add billions to that $7.5 billion marker for new charging stations, and to provide billions in tax credits to firms that build or retool factories that make batteries for EVs or semiconductors, all as a part of electrifying, over time, the American transportation sector.

More: Joe Biden's support of labor unions is historic. Here's what it means

Biden's aspirational order signed Thursday aside, the car companies, including the Detroit Three, noted that it is only with "the timely deployment" of help from the government that any such goal is likely to be reached. U.S. Sen. Debbie Stabenow, D-Mich., who is leading the push for incentives in that chamber, said they are a crucial step toward electrification and ensuring that American companies, instead of Chinese competitors, control the still-minuscule but growing U.S. market.

"The fact is, our American auto companies are competing specifically with China — where it is 100% government-funded," she said. "For our companies to compete with that, they have to have a partnership with the federal government. We've got to do our part."

More: No porridge or bears, but Biden's clean car goals get Goldilocks comparison

What that package of incentives will ultimately look like is still uncertain. Democratic U.S. Rep. Dan Kildee, who is helping to lead the effort in the House, said there is clearly a desire to balance the need for EVs with an industrial policy that creates and retains UAW jobs. "Failure to embrace this would be a mistake," he said.

Democratic U.S. Rep. Debbie Dingell, who is also pushing incentives for building and buying EVs, described what may be remembered as an inflection point, when Congress moved toward helping automakers address the three hurdles toward widespread EV adoption: the cost of the vehicles, their driving range and the availability of charging stations. It's a guess as to whether it will appropriately do so, however. On Friday, she was working on a letter to House leaders calling for $85 billion for charging stations as needed.

"If those things don't happen, this isn't going to work. Consumers aren't going to buy them," she said.

Incentives running into headwinds in Congress

Stabenow acknowledged that while the infrastructure bill — which also includes measures to study the impact of electric vehicles on the marketplace and power grid, as well as items that provide $1 billion in funding for Great Lakes restoration efforts and provisions she has pushed to force the U.S. government to buy American-made products — has bipartisan support, many of the incentives being looked at in the reconciliation bill have little or no Republican backing.

That's fine as far as it goes, since, under reconciliation, Democrats need only 51 votes in the 100-member Senate to pass such a bill. That's exactly how many they have, too, counting a tie-breaking vote by Vice President Kamala Harris. The problem is, it's not entirely clear whether Democrats have all those votes lined up for such a wide-ranging bill and whether all the measures Democrats want to include in the bill — which under Senate rules must be directly budgetary in nature to be included — will pass muster.

It would also have to pass in the U.S. House, where Democrats hold a slim eight-seat majority.

Already, there are concerns about some of those incentives, as to whether they are too generous or potentially violate free-trade rules against giving domestic producers favorable treatment over imports.

Questions about whether a part of a customer's subsidy should be tied to whether a vehicle was made by union labor also are coming up, and Stabenow said the oil and gas industry is lobbying fiercely against any incentives. Republicans, meanwhile, argue the market doesn't show enough demand for EVs to warrant the potential cost of incentives, including increasing the current $7,500 per vehicle maximum credit and getting rid of a cap that currently allows companies to receive that credit only until they've sold 200,000 electric or hybrid electric vehicles.

On Friday, the Wall Street Journal editorial board argued that if the EV future is such a given, as the industry touts, than incentives shouldn't be necessary. Instead, it said, the automakers' solution is "collusion with the Biden administration to regulate competition across the industry and raise prices for consumers," potentially shielding them from fighting it out in the marketplace.

"All of these pathways (toward increasing EV adoption) are literally fraught. There are alligators everywhere," said Genevieve Cullen, president of the Electric Drive Transportation Association, a trade group of vehicle manufacturers, suppliers, utilities and others promoting EV adoption. But she said if Democrats are able to write incentives into the federal tax code — even with the $12,500 buyer credit being written in such a way it would come directly off the price of the vehicle — it would be more difficult to remove it later on, even if Congress changes political hands.

While some may be skeptical, she said, given the enormous investments made by the car companies into new EV models and plants, there are good reasons to believe they are in earnest. "Just follow the money," she said.

Biden fuel standards could push EV sales but questions remain

Even as Biden was signing an executive order stating his goal for EV sales, other parts of his administration were reviving increased fuel standards for automakers that were reduced by former President Donald Trump. Those new rules could potentially work in concert with congressional incentives to help EV sales.

For instance, the proposed new rules would initially give automakers up to double the credit they might otherwise get toward their fleet-wide mile-per-gallon average for every EV they sell.

But even the Biden administration doesn't see the quick adoption of EVs, saying it expects them to account for only about 8% of U.S. auto sales by 2026, from about 2% in 2019. Dan Becker, director of the Center for Biological Diversity's Safe Climate Transportation Campaign, remained dubious, noting the automakers spend far more on advertising SUVs and trucks than on fuel-efficient or electric vehicles.

"Of course, people aren't buying them, they aren't marketing them," he said. "But they will when the Chinese come."

Becker said the fuel standards, which are enforceable, unlike the aspirational order or congressional incentives, should be far tougher, since gasoline-powered vehicles are going to remain the vast majority on the road in the U.S. for years to come unless there is an unprecedented shift, which is unlikely to happen overnight. He also noted that, when Trump took office in 2017, the auto companies were quick to ask for a relaxing of the standards former President Barack Obama had put in place in the aftermath of the 2008-09 recession, after his administration had bailed out General Motors and Chrysler and they could hardly refuse.

There is no guarantee, he said, if another president takes office in 2025, they won't do the same.

EVs have become a political football

That may especially be true if Trump, or an acolyte, takes office. The former president seemed more than willing to pick a fight with states that demanded the tougher fuel standards stay in place, a move that sparked dissension even among the car companies but may have motivated a political base that includes climate change deniers.

"Trump understood the value of day trading in politics," Kildee said. "It's true that in the short term, this (transition from gas-powered vehicles to electric ones) is tough stuff." He also acknowledged that "there is a certain amount of whiplash watching car companies respond to one administration and then the next."

He also said that he believes industry is ready to make the change and that it's needed. "It's tough because it comes down to a fundamental problem we have … that we can't seem to think past next week."

Brett Smith, director of technology for the Center for Automotive Research in Ann Arbor, said it's clear to him that the administration and industry is ready to make this change. "But I'm not sure government is," he said, meaning Congress and other elected officials. "There is a lot of push, shove and pull that's going to have to go into this."

And the fact that EVs have become a political football makes it no easier.

"Obama made EVs into a political football," Smith said. "Trump punted in a long way. … Now, Biden has picked it up and is running in the other direction."

But he said that brings with it a level of uncertainty that makes it very hard for companies to plan for the future.

"Other countries have industrial policies. We have one that changes every four years ... you really only have a couple of years to make a big change."

Contact Todd Spangler: tspangler@freepress.com. Follow him on Twitter @tsspangler. Read more on Michigan politics and sign up for our elections newsletter.